This article walks step-by-step through the full forgiveness form, 3508. A few important highlights:

The SBA’s new online SBA PPP Direct Forgiveness portal allows borrowers with loans of $150,000 or less to apply for forgiveness directly with the SBA.

Please note, the material contained in this article is for informational purposes only, is general in nature, and should not be relied upon or construed as a legal opinion or legal advice. Please keep in mind this information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

Tip: To follow along with this information, print out or download the PPP Loan Forgiveness Application (SBA Form 3508 revised January 19, 2021) before you start. Your lender may provide an online version of this form but it is helpful to have a printed copy for your notes.

Understand that completing this application will require a number of calculations. If you are not comfortable with this process, get help from your accountant or financial advisor.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

There is a lot to digest here and hopefully it will make sense once you approach it methodically. In this article, we provide both background information as well as details on specific questions related to the application when that information is available in official guidance.

Before we dive into details, let’s quickly review the Paycheck Protection Program (PPP) loan program. (This background may help if you see articles that don’t incorporate the latest changes, or if you are wondering why this round of forgiveness is a little different than before.)

The basic premise of PPP is that business owners—including those who are self-employed—can apply for a loan of 2.5 times their average monthly payroll. (Second draw borrowers in an industry with a NAICS code starting in 72 can apply for a loan based on 3.5 times average monthly payroll.) Once they get the loan, they are required to spend the funds during a specific period of time (soon after they get the loan) on approved expenses—mostly for payroll—and if they do so, can apply to have the entire amount forgiven.

Overall the process is supposed to work like this:

We’ll go into more details in this article.

Filling out your PPP forgiveness application will be very different depending on whether you have employees or not.

NOTE: If you are self employed and do not have W-2 employees read our article: Self Employed: How to Fill Out the PPP Loan Forgiveness Application Form

There are two other forgiveness applications that some businesses may use. The first is Form 3508EZ. You may qualify to use this form if you are self-employed with no employees, or you have generally not reduced employee headcount or wages. Additionally, on January 16, 2021 SBA released a new simplified application form that may be used by businesses that received $150,000 or less in PPP funds.

The SBA’s new online SBA PPP Direct Forgiveness portal allows borrowers with loans of $150,000 or less to apply for forgiveness directly with the SBA.

The most complicated part of filling out the forgiveness application is filling out the payroll sections. We’ll provide general information here but you may have questions unique to your situation. You may find answers in the SBA guidance, so be sure to review it. (It’s 62 pages long but there is a table of contents starting on page 9 that may help you find an answer more quickly.) Also keep in mind this information does not replace professional accounting or legal advice. In fact, we strongly encourage you to work with your accountant before you submit your application for forgiveness.

It does not include:

In general, payroll costs paid or incurred during the covered period are eligible for forgiveness. (More details of payroll expenses paid vs. incurred are listed in the FAQs below.) Salary, wages, or commission payments to furloughed employees, bonuses or hazard pay during the covered period may be eligible for forgiveness, provided they don’t exceed the $100,000 annual cap. (See the FAQs below for information on caps on owner-employee compensation.)Payments to independent contractors are not covered under the employer’s payroll. And payroll costs that are qualified wages taken into account in determining the Employer Retention Credit are not eligible for loan forgiveness.

Before we dive into the application, there are a couple of important questions you’ll need to be able to answer. Let’s tackle two of them right now.

On the first page of the application, you’ll see sections asking you to fill in:

Covered Period: _________ to __________

The covered period we are referring to here is the time period you have to spend your loan funds for forgiveness purposes. It is now 8-24 weeks after the loan is disbursed. (This applies to any PPP loan for which a loan forgiveness payment had not been remitted by SBA as of December 27, 2020.) You get to choose the number of weeks within that window, but it always is at least 8 weeks and begins when loan funds are disbursed (put into your bank account.) Note: You may see other periods listed in articles (or even used another period if you already applied for forgiveness for your first PPP loan). That’s because originally the CARES Act set that period at 8 weeks after the loan is disbursed. The PPP Flexibility Act passed in June 2020 changed it to 8 or 24 weeks. Because payroll and other expenses don’t always fall neatly into those periods, the SBA also created an “Alternative Covered Period.” That’s now eliminated.

Another term you’ll see throughout the application is “FTE,” which stands for Full-time Equivalent or Full-time Equivalency. This is a calculation based on the number of hours an employee works.

Full-time equivalent (FTE) can take into account both full-time and part-time employees. The PPP Forgiveness Application explains how to calculate FTE for PPP loan forgiveness. Here’s what it says:

“For each employee, enter the average number of hours paid per week, divide by 40, and round the total to the nearest tenth. The maximum for each employee is capped at 1.0. For employees who were paid for less than 40 hours per week, borrowers may choose to calculate the full-time equivalency in one of two ways. First, the borrower may calculate the average number of hours a part-time employee was paid per week during the covered period. For example, if an employee was paid for 30 hours per week on average during the covered period, the employee could be considered to be an FTE employee of 0.75. Similarly, if an employee was paid for ten hours per week on average during the covered period, the employee could be considered to be an FTE employee of 0.25. Second, for administrative convenience, borrowers may elect to use a full-time equivalency of 0.5 for each part-time employee…Borrowers may select only one of these two methods, and must apply that method consistently to all of their part-time employees for the covered period and the selected reference period.”

Make sure you understand that you have these options for calculating FTE. This calculation is going to be very important for forgiveness purposes as you’ll see when we walk through the application. There is a detailed discussion of FTE’s in the SBA’s January 19, 2021 Interim Final Rule (starting on page 31.) If you have reduced employee headcount, hours and/or wages, it is worth your time to read and understand it before you complete your forgiveness application.

As you follow along here, note that we have copied actual fields and their instructions from the SBA application. Tips in italics below those fields are our comments, based on our understanding of the current guidance.

To fill out the application, we find it easier not to start at the beginning. Instead, it may make sense to skip ahead to the PPP Schedule A Worksheet now on page 4 of the application. You’ll need to calculate information about employees’ hours and wages in order to plug that information back into the application.

Table 1: List employees who:

• Were employed by the Borrower at any point during the covered period covered period whose principal place of residence is in the United States; and

• Received compensation from the Borrower at an annualized rate of less than or equal to $100,000 for all pay periods in 2019 or were not employed by the Borrower at any point in 2019. (Note: Other employees will be in the next table.)

Let’s look at each of these fields:

Employee’s Name: Here you list each employee’s name. Do not include any independent contractors, owner-employees, self-employed individuals, or partners.

Employee Identifier: This is the last four digits of their Social Security numbers.

Enter Cash Compensation: Enter the sum of gross salary, gross wages, gross tips, gross commissions, paid leave (vacation, family, medical or sick leave, not including leave covered by the Families First Coronavirus Response Act), and allowances for dismissal or separation paid or incurred during the covered period.

Important: The application clarifies that: “For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of $100,000, as prorated for the covered period. For an 8-week Covered Period, that total is $15,385. For a 24-week Covered Period, that total is $46,154.

Average FTE: Earlier we talked about calculating FTE. The application states: “This calculates the average full-time equivalency (FTE) during the Covered Period. For each employee, enter the average number of hours paid per week, divide by 40, and round the total to the nearest tenth. The maximum for each employee is capped at 1.0. A simplified method that assigns a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours may be used at the election of the Borrower.”

FTE Reduction Exceptions:

Do you see the grey box in Table 1 on the application (page 4) that says “FTE Reduction Exceptions?” This is essentially where you identify employees who could not or would not return to work so you (ideally) won’t be penalized with a reduction in forgiveness.

Specifically, here you indicate the FTE of:

In all of these cases, include these FTEs on this line only if the position was not filled by a new employee. Any FTE reductions in these cases do not reduce the borrower’s loan forgiveness.

By way of background, the CARES Act and PPP Flexibility Act provide “safe harbors” that allow employers to avoid a reduction in forgiveness. In other words, reductions in employees and/or wages won’t always result in a reduction in forgiveness if these conditions are met.

By way of background, you may not be penalized for reducing headcount or wages in certain circumstances. Two separate safe harbors exempt certain borrowers from any loan forgiveness reduction based on a reduction in FTE employee levels:

There is a step-by-step calculation for the second FTE Reduction Safe Harbor. (It’s below Table 2 on page 4).

Step 1. Enter the borrower’s total average FTE between February 15, 2020 and April 26, 2020. Follow the same method that was used to calculate Average FTE in the PPP Schedule A Worksheet Tables. Sum across all employees and enter:________ Step 2. Enter the borrower’s total FTE in the borrower’s pay period inclusive of February 15, 2020. Follow the same method that was used in step 1:_________. Step 3. If the entry for step 2 is greater than step 1, proceed to step 4. Otherwise, FTE Reduction Safe Harbor 2 is not applicable and the borrower must complete line 13 of PPP Schedule A by dividing line 12 by line 11 of that schedule. Step 4. Enter the borrower’s total FTE (a) for a PPP loan made before December 27, 2020, as of December 31, 2020 or (b) for a PPP loan made after December 27, 2020, the last day of the covered period:_________ . Step 5. If the entry for step 4 is greater than or equal to step 2, enter 1.0 on line 13 of PPP Schedule A; the FTE Reduction Safe Harbor 2 has been satisfied. Otherwise, FTE Reduction Safe Harbor 2 does not apply and the Borrower must complete line 13 of PPP Schedule A by dividing line 12 by line 11 of that schedule.

Under the CARES Act, reducing salaries or wages during the covered period by more than 25% generally reduces forgiveness. But, again, there is a safe harbor provision. Let’s dive into how that actually works.

This is found on pages 5 & 6 of the application instructions:

For each employee listed in Table 1, complete the following (using salary for salaried employees and hourly wage for hourly employees):

Step 1. Determine if pay was reduced more than 25%.

1a. Enter average annual salary or hourly wage during the covered period: ______________.

1b. . Enter average annual salary or hourly wage during the most recent full quarter before the covered period: ______________.

1c. Divide the value entered in 1.a. by 1.b.: ______________.

If 1.c. is 0.75 or more, enter zero in the column above box 3 for that employee (note: this is the column titled Salary / Hourly Wage Reduction); otherwise proceed to Step 2.

Step 2. Determine if the Salary/Hourly Wage Reduction Safe Harbor is met.

2a. Enter the annual salary or hourly wage as of February 15, 2020: ______________.

2b. Enter the average annual salary or hourly wage between February 15, 2020 and April 26, 2020: ______________.

If 2.b. is equal to or greater than 2.a., skip to Step 3. Otherwise, proceed to 2.c.

2c. Enter the average annual salary or hourly wage as of (a) for a PPP loan made before December 27, 2020, December 31, 2020 or (b) for a PPP loan made after December 27, 2020, the last day of the covered period: ______________.

If 2.c. is equal to or greater than 2.a., the Salary/Hourly Wage Reduction Safe Harbor has been met – enter zero in the column above box 3 for that employee.

Otherwise proceed to Step 3.

Step 3. Determine the Salary/Hourly Wage Reduction.

3a. Multiply the amount entered in 1.b. by 0.75: ______________.

3b. Subtract the amount entered in 1.a. from 3.a.: ______________.

If the employee is an hourly worker, compute the total dollar amount of the reduction that exceeds 25% as follows:

3c. Enter the average number of hours worked per week between January 1, 2020 and March 31, 2020: ______________.

3d. Multiply the amount entered in 3.b. by the amount entered in 3.c. ______________. Multiply this amount by 24 (if borrower is using a 24-week covered period) or 8 (if borrower is using an 8-week covered period): ______________.

Enter this value in the column above box 3 for that employee.

If the employee is a salaried worker, compute the total dollar amount of the reduction that exceeds 25% as follows:

3e. Multiply the amount entered in 3.b. by 24 (if borrower is using a 24-week covered period) or 8 (if borrower is using an 8-week covered period): ______________.

Divide this amount by 52: ______________.

Enter this value in the column above box 3 for that employee.Boxes 1 through 5 Totals: Enter the sums of the amounts in each of the columns.

If you’ve made it this far, you have completed Table 1 on the PPP Schedule A Worksheet. Congratulations!

Now let’s fill out Table 2. We’ve bolded a few key items to make sure you read them carefully.

Table 2: List employees who:

Now you have completed the PPP Schedule A Worksheet. Congratulations!

If you couldn’t fill it out because you had questions about reductions in FTEs or Salary/Wages, we recommend you refer to the SBA guidance and consult your advisors. If that helps you maximize your forgiveness it will be worth it!

Get the credit your business deserves

Join 250,000+ small business owners who built business credit history with Nav Prime — without the big bank barriers.

Now you will use the information you just filled out to fill out the PPP Schedule A. This is found on Page 3 of the application.

Lines 1 – 5 should be pretty self-explanatory as they will be filled out using the information from the worksheet you just completed. (PPP Schedule A Worksheet)

These non-cash payroll costs may also be eligible for forgiveness. During the covered period:

Line 6. Total amount paid by Borrower for employer contributions for employee insurance: ___________________

Enter the total amount paid by the Borrower for employer contributions for employee group health, life, disability, vision, or dental insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after-tax contributions by employees. Do not add contributions for these benefits made on behalf of a self-employed individual, general partners, or owner-employees of an S-corporation, because such payments are already included in their compensation.

Line 7. Total amount paid by Borrower for employer contributions to employee retirement plans: ___________________

Enter the total amount paid by the borrower for employer contributions to employee retirement plans, excluding any pre-tax or after-tax contributions by employees. Do not add employer retirement contributions made on behalf of a self-employed individual or general partners, because such payments are already included in their compensation.

Line 8. Total amount paid by borrower for employer state and local taxes assessed on employee compensation: ___________________

Enter the total amount paid by the borrower for employer state and local taxes assessed on employee compensation (e.g., state unemployment insurance tax); do not list any taxes withheld from employee earnings.

These additional payroll costs may be included in the calculations for forgiveness purposes.

Line 9. Total amount paid to owner-employees/self-employed individual/general partners: _____________________

Enter any amounts the borrower paid to owners (owner-employees (with an ownership stake of 5% or more), a self employed individual, or general partners). For each individual owner in total across all businesses, this amount is capped at

(a) $20,833 (the 2.5-month equivalent of $100,000 per year), or

(b) the 2.5-month equivalent of the individual’s applicable compensation in the year that was used to calculate the loan amount (2019 or 2020), whichever is lower. (See more information about owner compensation in the FAQs below.)

10. Payroll Costs (add lines 1, 4, 6, 7, 8, and 9): ___________________

This figure goes on line 1 of the PPP Loan Forgiveness Calculation Form

If you satisfy any of the following three criteria, check the appropriate box, skip lines 11 and 12, and enter 1.0 on line 13; otherwise, complete lines 11, 12, and 13:

No reduction in employees or average paid hours: If you have not reduced the number of employees or the average paid hours of your employees between January 1, 2020 and the end of the Covered Period, check here ☐.

FTE Reduction Safe Harbor 1: If you were unable to operate between February 15, 2020, and the end of the Covered Period at the same level of business activity as before February 15, 2020 due to compliance with requirements established or guidance issued between March 1, 2020 and December 31, 2020, (or, with respect to a PPP loan made on or after December 27, 2020, between March 1, 2020 and the last day of the Covered Period with respect to such loan) by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration related to the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19, check here ☐.

FTE Reduction Safe Harbor 2: If you satisfy FTE Reduction Safe Harbor 2 (see PPP Schedule A Worksheet), check here ☐.

Line 11. Average FTE during the Borrower’s chosen reference period: _________

Enter the Borrower’s total average weekly full-time equivalency (FTE) during the chosen reference period. For purposes of this calculation, the reference period is, at the Borrower’s election, either (i) February 15, 2019 to June 30, 2019; (ii) January 1, 2020 to February 29, 2020; or (iii) in the case of seasonal employers, either of the preceding periods or a consecutive twelve-week period between May 1, 2019 and September 15, 2019.

For each employee, follow the same method that was used to calculate Average FTE on the PPP Schedule A Worksheet. Sum across all employees during the reference period and enter that total on this line. The calculations on lines 11, 12, and 13 will be used to determine whether the Borrower’s loan forgiveness amount must be reduced based on reductions in full-time equivalent employees, as required by the statute. Specifically, the actual loan forgiveness amount that the Borrower will receive may be reduced if the Borrower’s average weekly FTE employees during the Covered Period was less than during the Borrower’s chosen reference period. The Borrower is exempt from such a reduction and should skip lines 11 and 12, if any of the three criteria listed on PPP Schedule A under Full-Time Equivalency (FTE) Reduction Calculation has been met.

Line 12. Total Average FTE (add lines 2 and 5): ___________________

Remember Line 2 is based on Average FTE (Box 2) from PPP Schedule A Worksheet, Table 1 while Line 5 is Average FTE (Box 5) from PPP Schedule A Worksheet, Table 2.

Line 13. FTE Reduction Quotient (divide line 12 by line 11) or enter 1.0 if FTE Safe Harbor is met: ___________________

Divide line 12 by line 11 (or enter 1.0 if the FTE Reduction Safe Harbor has been met, according to PPP Schedule A Worksheet—FTE Reduction Safe Harbor). If more than 1.0, enter 1.0. You’ll enter this amount on line 7 of the Loan Forgiveness Calculation Form when we get there.

Now that the calculations in the worksheets are completed, you should be able to fill out the rest of the application. We’ll go back to page 1 of the application.

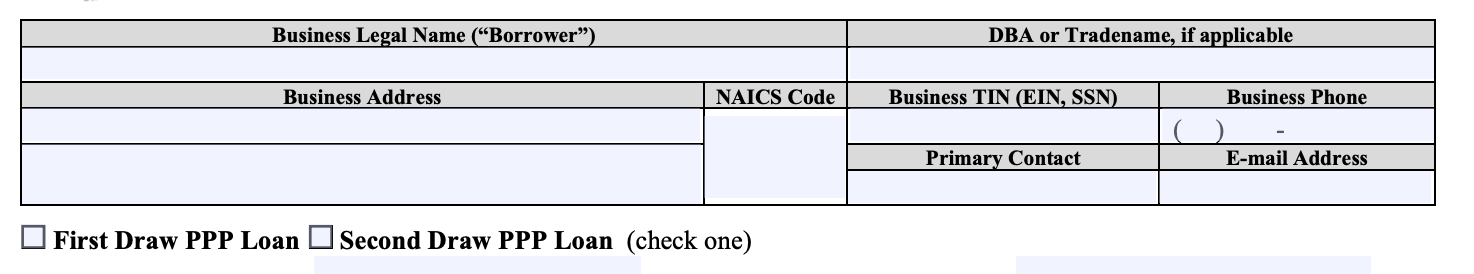

First you’ll fill out some basic information about your business:

This information should be straightforward, and you will generally use the information you used to apply unless it has changed from the time you applied.

If this is your first PPP loan, check the box that says First Draw PPP Loan. If it’s your second PPP loan, check the box that says Second Draw PPP Loan.

Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted.

SBA PPP Loan Number: ________________________

This is the number assigned by the SBA to your loan. If you don’t have it, ask your lender.

Lender PPP Loan Number: __________________________

Enter the loan number assigned to the PPP loan by the Lender. Again, if you don’t know, ask your lender.

PPP Loan Amount: _____________________________

This is the amount you received.

PPP Loan Disbursement Date: _______________________

Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.

Employees at Time of Loan Application: ___________

Enter the total number of employees at the time of the Borrower’s PPP Loan Application.

Employees at Time of Forgiveness Application: ___________

Enter the total number of employees at the time the borrower is applying for loan forgiveness. Same question as the previous question.

Covered Period: _________ to __________

We discussed these two periods at the beginning of this article.

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, or Second Draw PPP Loans of $2 Million or More, check here: ☐

Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates (85 FR 20817 (April 15, 2020)) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with or without affiliates) make sure you review this with your advisors.

Payroll and Nonpayroll Costs

This is where the information you filled out earlier for the worksheets will be helpful:

Line 1. Payroll Costs (enter the amount from PPP Schedule A, line 10): _____________________

Enter total eligible payroll costs incurred or paid during the covered period. Enter the amount you calculated and entered earlier on Line 10 of the PPP Schedule A.

Nonpayroll Costs: For the following nonpayroll costs (line 2-8), you are not required to report payments that you do not want to include in the forgiveness amount. The expenditures in lines 5-8 were added by the Economic Aid Act.

“An eligible nonpayroll cost must be paid during the covered period or incurred during the covered period and paid on or before the next regular billing date, even if the billing date is after the covered period. Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount. Count non-payroll costs that were both paid and incurred only once.”

Line 2. Business Mortgage Interest Payments: _____________________

Enter the amount of business mortgage interest payments during the covered period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

Line 3. Business Rent or Lease Payments: _____________________

Enter the amount of business rent or lease payments for real or personal property during the covered period, pursuant to lease agreements in force before February 15, 2020. (See additional information about rent in the FAQs below.)

Line 4. Business Utility Payments: _____________________

Enter the amount of business utility payments paid or incurred during the covered period, for business utilities for which service began before February 15, 2020. Under the CARES Act, utility includes payment for a service for the distribution of electricity, gas, water, transportation, telephone, or internet access.

Line 5. Covered Operations Expenditures: ________

Enter the amount of covered operations expenditures paid or incurred during the covered period. These are listed on the application as “payments for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting of tracking of supplies, inventory, records, and expenses.”

Line 6. Covered Property Damage Costs: ______

Enter the amount of covered property damage costs paid or incurred during the covered period. These are described as “costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation.”

Line 7. Covered Supplier Costs: ________

Enter the amount of covered supplier costs paid or incurred during the covered period pursuant to a contract, order, or purchase order in effect prior to the beginning of the covered period (for perishable goods, the contract, order, or purchase order must have been in effect before or at any time during the covered period). These are described in the application as “expenditures made to a supplier of goods for the supply of goods that are essential to the operations of the borrower at the time at which the expenditure is made, and made pursuant to a contract, order, or purchase order in effect prior to the beginning of the covered period (for perishable goods, the contract, order, or purchase order may have been in effect before or at any time during the covered period).”

Line 8. Covered Worker Protection Expenditures: _________

Enter the amount of covered worker protection expenditures paid or incurred during the Covered Period. These are described in the application as “operating or capital expenditures that facilitate the adaptation of the business activities of an entity to comply with the requirements established or guidance issued by the Department of Health and Human Services, the Centers for Disease Control, or the Occupational Safety and Health Administration, or any equivalent requirements established or guidance issued by a State or local government, during the period starting March 1, 2020 and ending on the date on which the national emergency declared by the President with respect to the Coronavirus Disease 2019 (COVID-19) expires related to maintenance standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19, but does not include residential real property or intangible property.”

Adjustments for Full-Time Equivalency (FTE) and Salary/Hourly Wage Reductions

Line 9. Total Salary/Hourly Wage Reduction (enter the amount from PPP Schedule A, line 3): _____________________

This amount reflects the loan forgiveness reduction required for salary/hourly wage reductions in excess of 25% for certain employees as described in PPP Schedule A.

Line 10. Add the amounts on lines 1, 2, 3, and 4, then subtract the amount entered in line 5: _____________________

If this amount is less than zero, enter a zero.

Line 11. FTE Reduction Quotient (enter the number from PPP Schedule A, line 13): _____________________

Enter the number from PPP Schedule A, line 13.

Potential Forgiveness Amounts

Line 12. Modified Total (multiply line 10 by line 11): _____________________

Enter the amount on line 10 multiplied by the amount on line 11. This calculation incorporates the loan forgiveness reduction required for any full-time equivalency (FTE) employee reductions as described in PPP Schedule A.

Line 13. PPP Loan Amount: _____________________

Enter the loan amount you received from your lender.

Line 14. Payroll Cost 60% Requirement (divide line 1 by 0.60): _____________________

Divide the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs. Note that you should divide by .60 here – don’t multiply!

Forgiveness Amount Line 15. Forgiveness Amount (enter the smallest of lines 12, 13, and 14): _____________________

If you’ve made it this far, you have calculated your potential forgivable amount. Congratulations!

On page 2 of the application you’ll see a list of representations and certifications the borrower must make. These will no doubt make some borrowers nervous about potentially running afoul of the rules and either not qualifying for forgiveness, or worse, putting themselves at risk of criminal penalties. If you are uncertain about any of the (often confusing) calculations in this application, you should get help from a legal or tax professional.

Note that one of the certifications requires you to certify that if this application is for a Second Draw loan, you must have used all First Draw PPP loan amounts on eligible expenses prior to disbursement of the Second Draw PPP Loan.

You must to keep certain records documenting forgiveness for six years after the date the loan is forgiven or paid in full. In addition, you must “permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request.”

The documentation requirements are found on pages 7 and 8 of the instructions.

Finally there is an optional PPP Borrower Demographic Information Form. It’s up to you whether you want to fill this out though it may be helpful to understand the demographics of business owners served by this program.

There have been a number of questions answered by the SBA, and they have been gathered in the Interim Final Rule published January 19, 2021. We recommend you review that document carefully. There are still unanswered questions, however, so more guidance may be coming.

Generally, you can apply for forgiveness after you’ve spent your PPP funds (after your “covered period.”). However, note that a borrower applying for forgiveness of a Second Draw PPP Loan that is more than $150,000 must submit the loan forgiveness application for its First Draw PPP Loan before or simultaneously with the loan forgiveness application for its Second Draw PPP Loan.

If you delay too long, however, you may have to start making payments on the loan. The SBA explains: “If the borrower does not apply for loan forgiveness within 10 months after the last day of the maximum covered period of 24 weeks, or if SBA determines that the loan is not eligible for forgiveness (in whole or in part), the PPP loan is no longer deferred and the borrower must begin paying principal and interest. If this occurs, the lender must notify the borrower of the date the first payment is due.”

No. And thanks to the Economic Aid Act you may also deduct eligible expenses paid for with PPP funds. Keep in mind state taxing authorities may treat these forgiven loan funds differently. Read: Are Forgiven PPP Loans Taxable?

Yes, the SBA Administrator has determined that, if an employee’s total compensation does not exceed $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred, the employee’s hazard pay and bonuses are eligible for loan forgiveness because they constitute a supplement to salary or wages, and are thus a similar form of compensation.

Yes. Forgiveness is capped at 2.5 months’ worth (2.5/12) of an owner-employee or self-employed individual’s 2019 or 2020 compensation (up to a maximum $20,833 per individual in total across all businesses). The individual’s total compensation may not exceed $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred.

For example, for borrowers that elect to use an eight-week covered period, the amount of loan forgiveness requested for owner-employees and self-employed individuals’ payroll compensation is capped at eight weeks’ worth (8/52) of 2019 or 2020 compensation (i.e., approximately 15.38 percent of 2019 or 2020 compensation) or $15,385 per individual, whichever is less, in total across all businesses. For borrowers that elect to use a ten-week covered period, the cap is ten weeks’ worth (10/52) of 2019 or 2020 compensation (approximately 19.23 percent) or $19,231 per individual, whichever is less, in total across all businesses. For a covered period longer than 2.5 months, the amount of loan forgiveness requested for owner-employees and self-employed individuals’ payroll compensation is capped at 2.5 months’ worth (2.5/12) of 2019 or 2020 compensation (up to $20,833) in total across all businesses.

In particular, C-corporation owner-employees are capped by the prorated amount of their 2019 or 2020 (the same year used to calculate loan amount) employee cash compensation and employer retirement and health, life, disability, vision and dental insurance contributions made on their behalf. S-corporation owner-employees are capped by the prorated amount of their 2019 or 2020 employee cash compensation and employer retirement contributions made on their behalf. However, employer health, life, disability, vision and dental insurance contributions made on their behalf cannot be separately added; those payments are already included in their employee cash compensation. Schedule C or F filers are capped by the prorated amount of their owner compensation replacement, calculated based on 2019 or 2020 net profit or gross income.

General partners are capped by the prorated amount of their 2019 or 2020 net earnings from self-employment (reduced by claimed section 179 expense deduction, unreimbursed partnership expenses, and depletion from oil and gas properties) multiplied by 0.9235. For self-employed individuals, including Schedule C or F filers and general partners, retirement and health, life, disability, vision or dental insurance contributions are included in their net self-employment income and therefore cannot be separately added to their payroll calculation. LLC members are subject to the rules based on their LLC’s tax filing status in the reference year used to determine their loan amount.

Owner-employees with less than a 5 percent ownership stake in a C- or Scorporation are not subject to the owner-employee compensation rule.

Payroll costs are considered paid on the day that paychecks are distributed or the borrower originates an ACH credit transaction. Payroll costs incurred during the borrower’s last pay period of the covered period are eligible for forgiveness if paid on or before the next regular payroll date; otherwise, payroll costs must be paid during the covered period to be eligible for forgiveness. Payroll costs generally are incurred on the day the employee’s pay is earned (i.e., on the day the employee worked). For employees who are not performing work but are still on the borrower’s payroll, payroll costs are incurred based on the schedule established by the borrower (typically, each day that the employee would have performed work).

No, the amount of loan forgiveness requested for nonpayroll costs may not include any amount attributable to the business operation of a tenant or sub-tenant of the PPP borrower or, for home-based businesses, household expenses. The examples below (directly from the SBA guidance) illustrate this rule.

Example 1: A borrower rents an office building for $10,000 per month and sub-leases out a portion of the space to other businesses for $2,500 per month. Only $7,500 per month is eligible for loan forgiveness.

Example 2: A borrower has a mortgage on an office building it operates out of, and it leases out a portion of the space to other businesses. The portion of mortgage interest that is eligible for loan forgiveness is limited to the percent share of the fair market value of the space that is not leased out to other businesses. As an illustration, if the leased space represents 25% of the fair market value of the office building, then the borrower may only claim forgiveness on 75% of the mortgage interest.

Example 3: A borrower shares a rented space with another business. When determining the amount that is eligible for loan forgiveness, the borrower must prorate rent and utility payments in the same manner as on the borrower’s 2019 tax filings, or if a new business, the borrower’s expected 2020 tax filings.

Example 4: A borrower works out of his or her home. When determining the amount of nonpayroll costs that are eligible for loan forgiveness, the borrower may include only the share of covered expenses that were deductible on the borrower’s 2019 tax filings, or if a new business, the borrower’s expected 2020 tax filings.

No. In calculating the loan forgiveness amount, a borrower may exclude any reduction in full-time equivalent employee headcount that is attributable to an individual employee if:

Under section 206(c) of the Taxpayer Certainty and Disaster Tax Relief Act of 2020, an employer that is eligible for the employee retention credit (ERC) can claim the ERC even if the employer has received a Small Business Interruption Loan under the Paycheck Protection Program (PPP). The eligible employer can claim the ERC on any qualified wages that are not counted as payroll costs in obtaining PPP loan forgiveness. Any wages that could count toward eligibility for the ERC or PPP loan forgiveness can be applied to either of these two programs, but not both.

In other words, no double dipping. This means you’ll want to be extra careful choosing your covered period if you plan to take advantage of both programs. Be sure to talk with your tax professional as soon as possible.

This article was originally written on May 21, 2020 and updated on October 5, 2021.

This article currently has 47 ratings with an average of 4.5 stars.